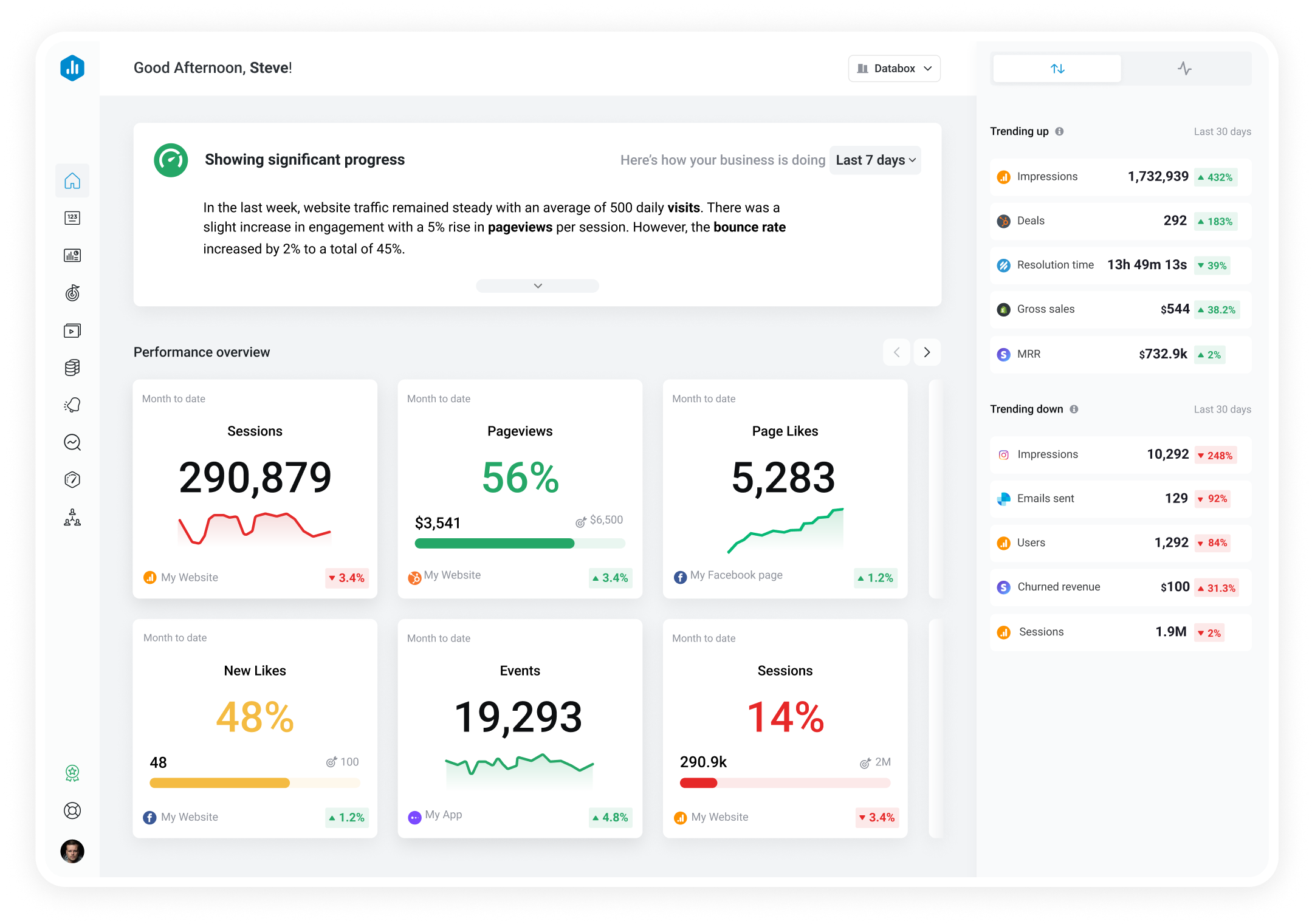

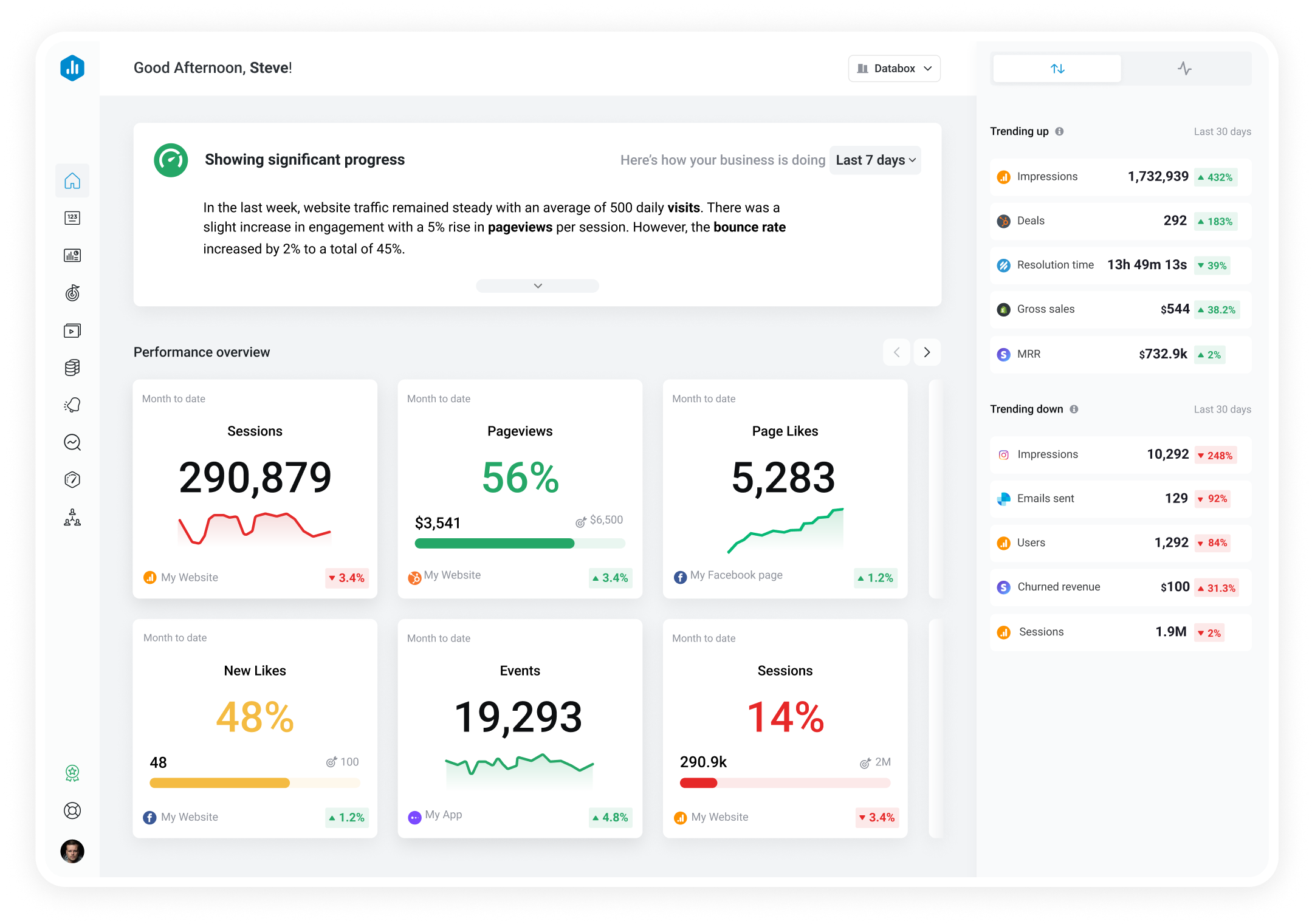

Track all of your key business metrics from one screen

GET STARTED

WooCommerce

Taxes

WooCommerce

Taxes Total taxes collected in WooCommerce Analytics, showing tax contributions.

With Databox you can track all your metrics from various data sources in one place.

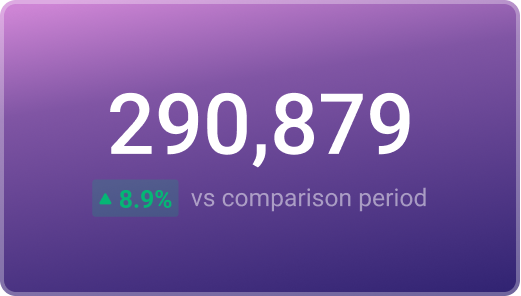

Used to show a simple Metric or to draw attention to one key number.

Databox is a business analytics software that allows you to track and visualize your most important metrics from any data source in one centralized platform.

To track Taxes using Databox, follow these steps:

Goals

Goals Scorecards

Scorecards Metric Digest

Metric Digest Metric Builder

Metric Builder Data Calculations

Data Calculations Performance Screen

Performance Screen