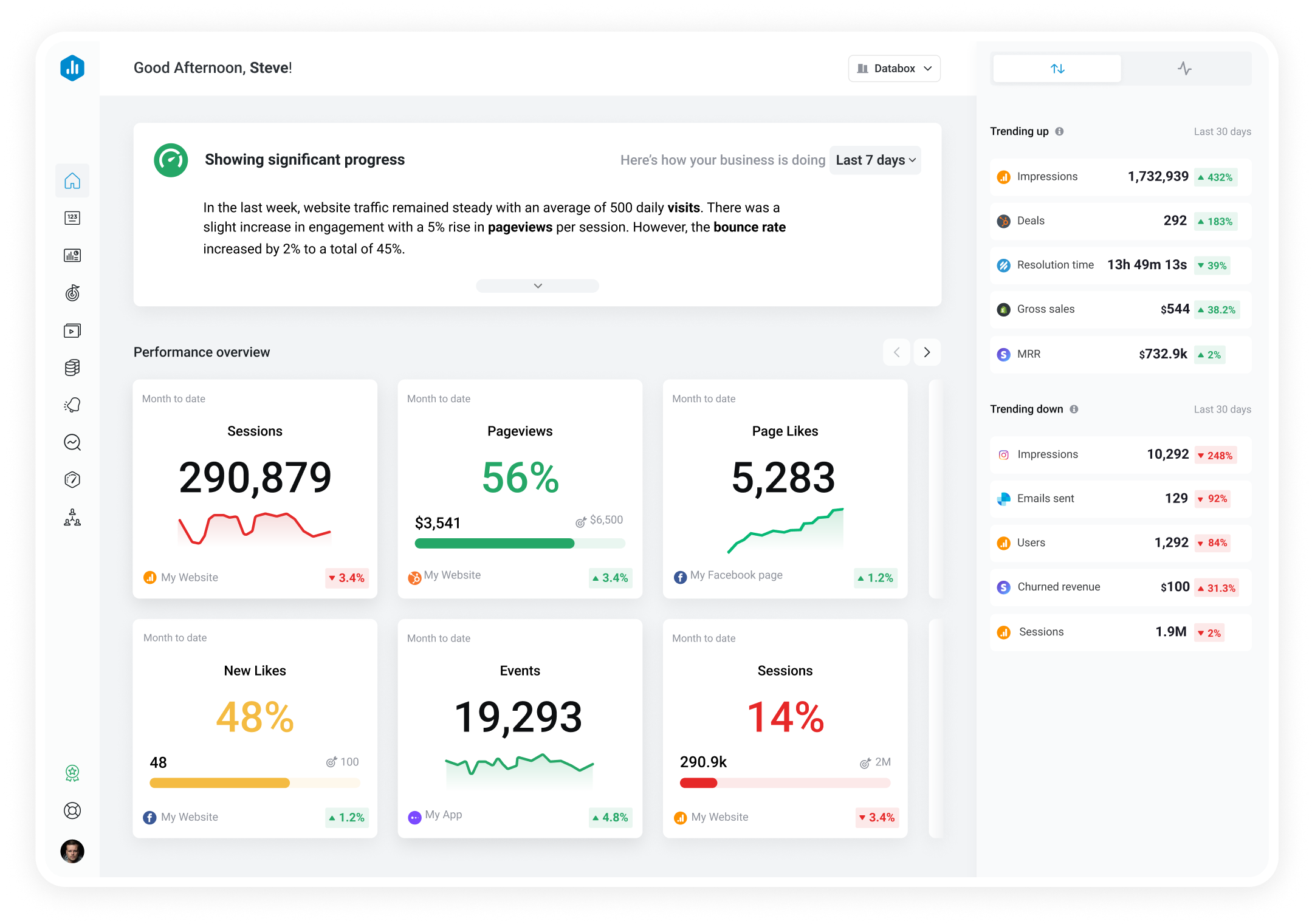

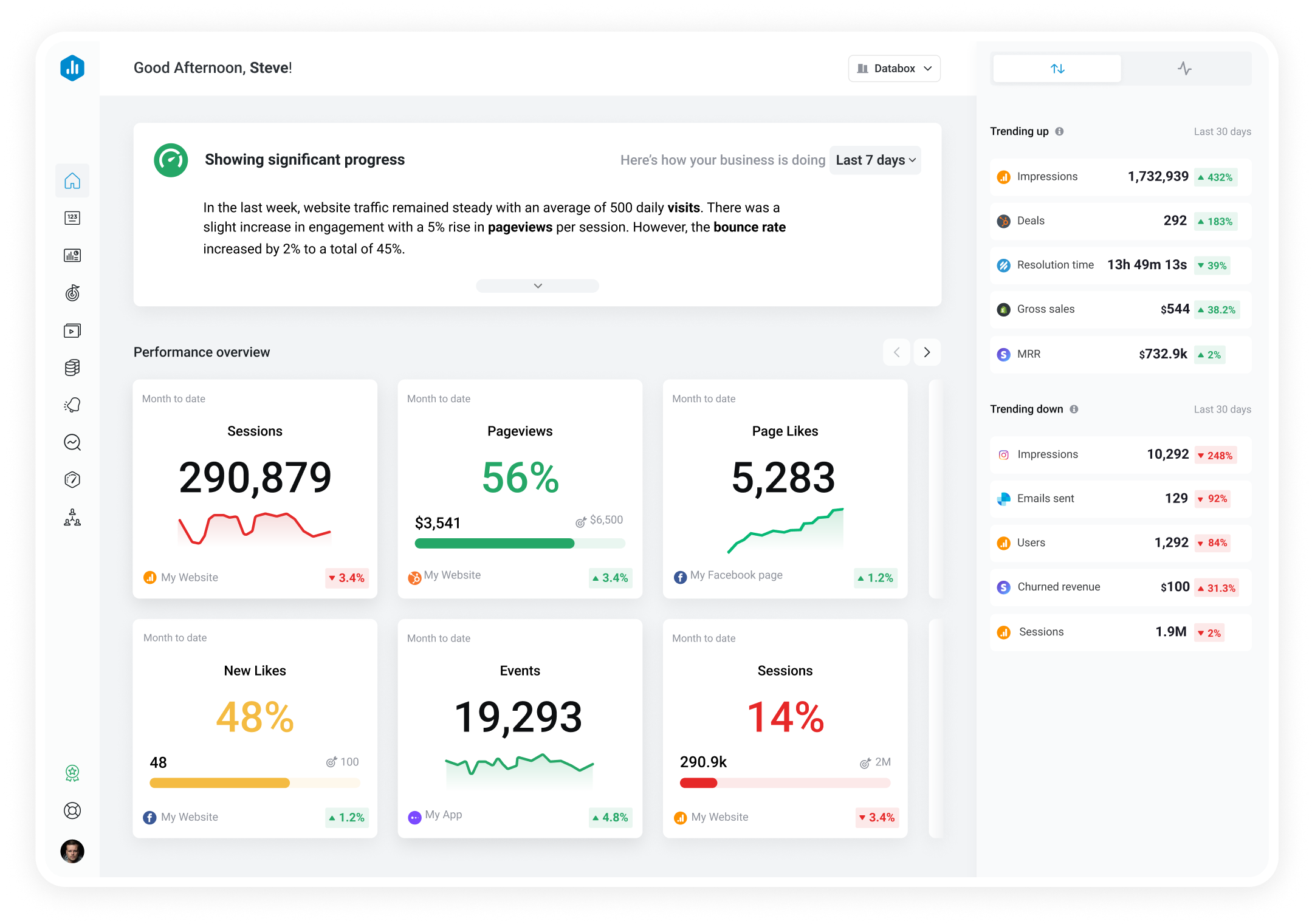

Track all of your key business metrics from one screen

GET STARTED

Xero

Gross Profit Margin

Xero

Gross Profit Margin Gross Profit Margin is a financial metric that measures how much profit a company makes after deducting the cost of goods sold from its revenue.

With Databox you can track all your metrics from various data sources in one place.

Gross profit margin is a financial metric that showcases the profitability of a company’s core operations by analyzing the relationship between its revenue and the cost of goods sold.

It’s the percentage of revenue that remains after deducting the direct costs associated with producing or purchasing the goods or services sold by the company.

To calculate your gross profit margin, you need two key figures – revenue and the cost of goods sold.

Once you have these numbers, you can use the following formula:

Gross Profit Margin = (Gross Profit / Revenue) * 100

For example, let’s say a company generates $500,000 in revenue and incurs $250,000 as the cost of goods sold.

The gross profit for that company would be $250,000. Now, we can apply the formula:

Gross Profit Margin = ($250,000 / $500,000) * 100

In this example, we find that the gross profit margin is 50%.

Unfortunately, the only correct answer to what a good gross profit margin is – it depends.

Because there are so many factors (e.g., industry, size, business model) that influence your specific gross profit margin, it can be hard to pinpoint what’s good without digging deep into your performance.

That said, we pulled out some specific numbers from our product that you might find useful.

A good gross profit margin for SaaS and B2B companies in Xero is from 60% to 80%, according to Xero Financial KPIs for SaaS and B2B Companies.

A good gross profit margin for all companies in QuickBooks is around 67%, according to QuickBooks Benchmarks for All Companies.

If you want to stay on top of future trends and be able to instantly compare your performance to companies just like yours (in any given industry), you can join our Benchmark Groups – it’s free for everyone!

Depending on your industry and specific business model, some strategies will work better than others.

And while one-size-fits-all strategies don’t really exist, there are some tactics that industry experts in most industries turn to in their own businesses:

More resources to help you improve:

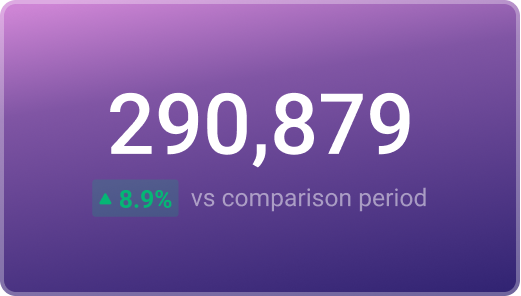

Used to show a simple Metric or to draw attention to one key number.

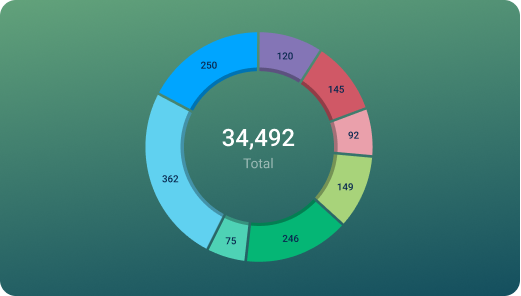

Used to illustrate numerical proportions through the size of the slices.

Used to show comparisons between values.

Databox is a business analytics software that allows you to track and visualize your most important metrics from any data source in one centralized platform.

To track Gross Profit Margin using Databox, follow these steps:

Goals

Goals Scorecards

Scorecards Metric Digest

Metric Digest Metric Builder

Metric Builder Data Calculations

Data Calculations Performance Screen

Performance ScreenThe Xero Profit & Loss (P&L) Overview dashboard provides a detailed view of income, expenses, gross profit, and net profit trends. It includes net profit breakdowns by type and visual comparisons of revenue vs. expenses over time.

This report gives a snapshot of financial results using Xero data on income, expenses, cash flow, balance sheet, and overall financials, supporting informed financial decisions.

Gross margin is the percentage of revenue remaining after deducting the cost of goods sold, while net margin is the percentage of revenue remaining after subtracting all expenses, including operating expenses, interest, and taxes.

Gross margin is a percentage that represents the proportion of revenue remaining after deducting the cost of goods sold, while gross profit is the actual monetary value.